Our Data Tracked the DUOL Crash Before Wall Street Did

TickerTrends data flagged Duolingo’s slowdown weeks before Wall Street caught on — revealing the power of real-time KPI forecasting to get ahead of market reversals.

Back in June, we published this article and the above tweets,

highlighting the peak of Duolingo’s growth story. At the time, DUOL 0.00%↑ was trading near all-time highs, over $520 a share, and the narrative was all about viral traction the product experienced after the successful “RIP Duo” campaign.

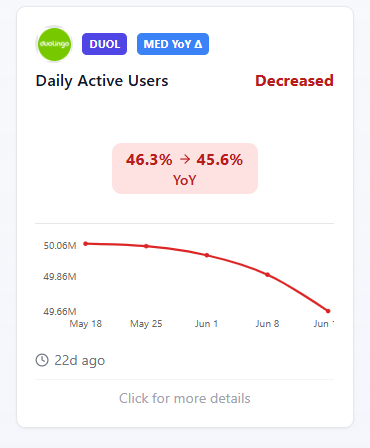

But our data was flashing early warning signals that not only indicated a slowdown in consumer social interest, but also a decline in specific metrics.

Since then, DUOL 0.00%↑ stock has fallen to $385/share… a drop of more than 25%.

Most investors were still chasing stale headlines and past earnings performance, but at TickerTrends, we track synthesize real-time alternative data metrics like app rankings/DAUs, website traffic, TikTok impressions, Google Search interest, Instagram follower growth and much more into actionable KPI predictions. And that data showed a different story playing out beneath the surface. We update these forecasts weekly and Enterprise subscribers to our platform clearly saw the slowdown early.

Each individual Data Source KPIs we track show significant year-over-year decelerations. Even DAU growth, while still strong, was no longer accelerating at the same pace. The signs were there. Growth had peaked. The excitement was wearing off.

What happened next wasn’t a surprise to us. But it did surprise most of the market.

Our article (released June 15, 2025) came out well before Wall Street caught on to the thesis.

For example, a prominent sell-side firm released a DUOL report outlining the exact issues we had flagged weeks earlier on June 25, 2025. They warned about deteriorating Instagram follower growth, weaker Google and TikTok engagement, but reiterated a stronger outlook for the back half of the year, which in our view remains uncertain. They even cited our data directly in the analyst note.

It’s clear that sell side is now leaning on our alternative data.

Investors who followed our KPI revisions were able spot divergences in expectations weeks in advance. This is the value of real-time KPI forecasting. Our goal is to use leading indicators that shift before earnings or price action does.

Duolingo is the latest example, but it won’t be the last. And as more sell-side firms cite our data, it’s a clear sign that investors are starting to recognize the power of using TickerTrends data.

Bottom line

We didn’t just spot the DUOL reversal. We forecasted it early, while most of the market was still bullish. And now, Wall Street caught up. Following future quarter forecasts and revisions will be important to follow along with!

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise