What’s Trending with TickerTrends #22

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Gap Inc. ($GAP):

Read our detailed analysis here:

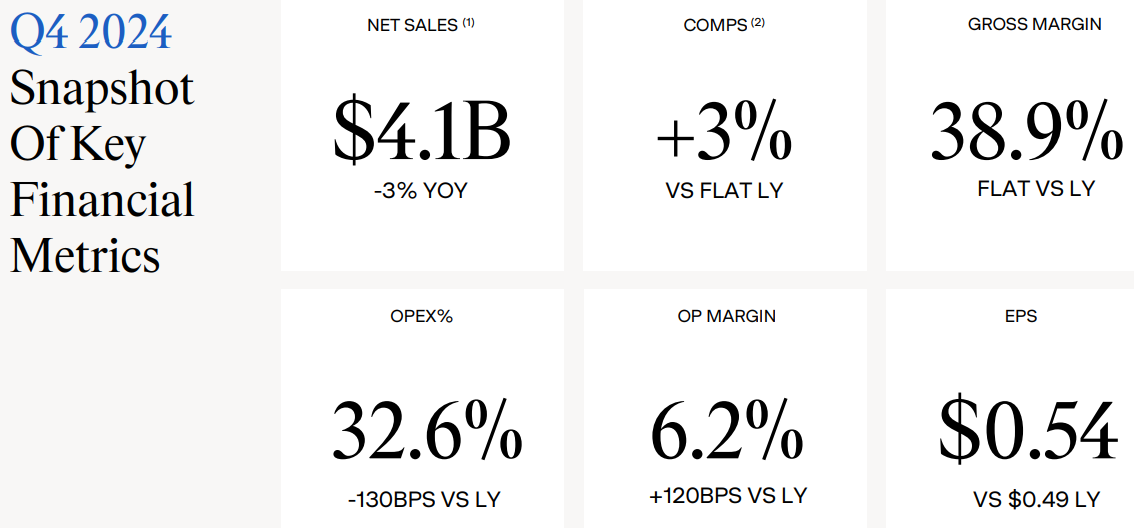

Gap Inc. delivered a strong fourth quarter, capping off an exceptional fiscal year 2024 with consistent sales growth, market share gains, and improved profitability. The company reported comparable sales growth of 3%, with all four of its brands—Old Navy, Gap, Banana Republic, and Athleta—either maintaining or gaining market share. Despite a 3% year-over-year revenue decline to $4.15 billion due to the loss of a 53rd week, the company’s core performance remained robust, with a gross margin of 38.9% and earnings per share (EPS) of $0.54, a 10% increase over Q4 2023.

For the full fiscal year, Gap Inc. achieved $15.1 billion in revenue, up 1% year-over-year, and an operating margin of 7.4%, the highest since 2018. EPS for 2024 reached $2.20, reflecting 64% growth from the prior year. Operating income surged 83% to $1.1 billion, driven by disciplined expense management, supply chain efficiencies, and brand revitalization efforts. The company generated $1 billion in free cash flow and ended the year with a strong balance sheet, holding $2.6 billion in cash.

Old Navy delivered 3% comp growth in Q4, securing its position as the #1 specialty apparel brand in the U.S. The brand continued to gain market share, with strength in denim and activewear, where it became the #5 player in the U.S. and the only brand in the top five to gain share. Gap accelerated with 7% comp growth, marking its fifth consecutive quarter of positive comps and seventh consecutive quarter of market share gains. The brand is regaining cultural relevance through strategic product innovation, marketing, and collaborations.

Banana Republic delivered 4% comp growth, showing improvement in the women's segment and continued strength in menswear and core classics. Meanwhile, Athleta faced challenges with a 2% decline in comps, though it gained market share. The brand is undergoing a strategic reset, focusing on core customer engagement and product innovation.

Gap Inc. continues to execute its brand reinvigoration playbook, leveraging innovation, marketing, and operational discipline. Technology and AI investments will enhance customer personalization, supply chain efficiency, and product development. The company also aims to strengthen omnichannel capabilities, with online sales up 4% in 2024, accounting for 38% of total revenue. Gap Inc. expects 1-2% revenue growth in 2025, driven by strength in Old Navy and Gap, stabilization at Banana Republic, and continued recovery efforts at Athleta. Operating income is projected to grow 8-10%, supported by slight gross margin expansion and $150 million in SG&A cost savings. Capital expenditures will increase 34% to $600 million, reflecting confidence in future growth opportunities. The board also authorized a 10% dividend increase and repurchased $75 million in shares, with $400 million remaining under the buyback authorization.

Abercrombie & Fitch Co ($ANF):

Abercrombie & Fitch delivered a strong fourth quarter, exceeding expectations and closing out a record-breaking fiscal year 2024. The company reported 9% net sales growth in Q4, or 14% excluding the 53rd-week impact from 2023, with comparable sales up 14%. Abercrombie brand comps rose 5%, marking its 16th consecutive quarter of growth, while Hollister delivered an impressive 24% comp increase. Strong traffic and customer demand fueled net sales growth across all regions, with 11% growth in the Americas, 2% in EMEA, and a 4% decline in APAC due to store closures and currency headwinds. Despite higher freight costs, the company expanded operating margins by 90 basis points to 16.2%, and earnings per share (EPS) increased 20% to $3.57.

For the full fiscal year, Abercrombie & Fitch achieved record-breaking results, with net sales growing 16% to $4.95 billion. Operating income surged 53% to $741 million, driving an operating margin of 15%. EPS reached $10.69, a 72% increase over the prior year. Both Abercrombie and Hollister brands achieved double-digit net sales growth, with Abercrombie up 16% and Hollister up 15%. The company saw strong demand across key categories, including denim, activewear, fleece, and dresses, and successfully expanded its customer base through marketing initiatives like The Wedding Shop and partnerships with the NFL and Formula 1. Hollister’s turnaround continued, with targeted store remodels, social media engagement, and product innovation driving strong teen customer engagement.

Abercrombie & Fitch maintained disciplined inventory management, with total inventory increasing 22% due to a 6% increase in units to support expected Q1 2025 growth, higher freight costs, and mix shifts into higher-cost categories like dresses and licensed products. The company generated over $500 million in free cash flow, which allowed it to fully eliminate funded debt and repurchase 3% of its shares outstanding at the beginning of the year. Store productivity remained high, with 125 new store experiences in 2024, including 65 new store openings, 12 rightsizings, and 48 remodels. The company ended the year with a 30% four-wall operating margin across its store fleet.

Abercrombie & Fitch expects net sales growth of 3-5%, with both brands contributing to revenue expansion. The company anticipates operating margins in the range of 14-15%, with higher freight costs and a more normalized seasonal carryover inventory weighing on the first half, before improving in the back half of the year. The company also expects foreign currency headwinds of approximately 70 basis points and a $5 million impact from tariffs on Chinese, Canadian, and Mexican imports. Capital expenditures are projected at $200 million, with plans to open 100 new store experiences, including 60 new stores and 40 remodels or rightsizings.

The company also announced a new $1.3 billion share repurchase authorization and plans to buy back approximately $100 million in shares per quarter in 2025, subject to market conditions. With a strong balance sheet, disciplined inventory management, and continued investment in marketing, digital, and omnichannel growth, Abercrombie & Fitch remains well-positioned for another year of profitable expansion. Management is focused on maintaining the momentum in Hollister while driving continued growth in Abercrombie, leveraging its agile read-and-react inventory model and strong customer engagement strategies.

Trends this week:

Crocs Inc ($CROX):

This week’s trending footwear release comes from an unexpected yet highly anticipated collaboration between A Bathing Ape (Bape) and Crocs. The two brands, both known for their extensive collaborative histories, have joined forces for the first time to create a limited-edition Bape x Crocs Classic Clog Collection. The collaboration features Crocs’ Classic Clog silhouette, redesigned with Bape’s signature ABC Camo print in three distinct colorways: Chai (Olive), Oxygen (Blue), and Carnation (Pink). This blend of Bape’s streetwear heritage and Crocs’ casual comfort aesthetic is expected to make a major impact in both the sneaker and fashion communities.

The collection is set to release in two waves. The first dropped on March 8, 2025, exclusively through Bape’s online store (us.bape.com) and is already sold out. A wider release is set to follow on March 12, 2025, via Crocs.com, likely launching at 11 AM ET, as is standard for Crocs’ product drops. Pricing is set at $80 for adult pairs (sizes 6-12) and $50 for kids’ sizes (C11-J6). What sets this collection apart is the attention to detail and customization options. Each pair of clogs comes equipped with Bape-branded Jibbitz charms, featuring iconic symbols like the Ape Head, Baby Milo, Shark, and Tiger motifs, as well as the brand’s "Ape Shall Never Kill Ape" slogan. The adjustable heel strap, which is also printed with the camouflage pattern, adds an extra layer of branding and functionality. Additionally, the footbed features co-branded Bape x Crocs logos, reinforcing the fusion of the two brands.

Beyond aesthetics, Crocs has also incorporated sustainable elements into this release. The clogs are made from an updated version of Crocs’ Croslite foam, which now contains 25% bio-circular materials, including repurposed cooking oil from other industries. This marks a continued shift in the industry towards more environmentally conscious footwear production, aligning with Crocs' broader sustainability initiatives. The collaboration speaks to Crocs’ ongoing expansion into the streetwear and sneaker world, following successful partnerships with Dragon Ball Z, Pokémon, CLOT, and BEAMS. Over the past few years, the once-polarizing footwear brand has strategically aligned itself with pop culture and street fashion trends, further cementing its influence in the space. For Bape, this project adds to its long list of high-profile collaborations, which have included brands like Adidas, KidSuper, and even luxury fashion houses.

Given Bape’s history of limited-edition, high-demand releases, this collection is expected to sell out quickly and could hold significant resale value in the secondary market. It would be interesting to see if this could lead to a turnaround for the brand and return them to growth.

Target Corp ($TGT):

This week Target has been at the center of a growing 40-day consumer boycott following its decision to phase out diversity, equity, and inclusion (DEI) initiatives. The protest, organized by Atlanta-based Pastor Jamal Bryant and other civil rights leaders, calls on shoppers to abstain from spending at Target from March 5 through April 17, 2025, aligning with the Lenten season. This follows a 24-hour economic blackout on February 28.

The backlash stems from Target's decision in January 2025 to end several DEI programs, including its Racial Equity Action and Change (REACH) initiative. The company had previously committed $2 billion to Black-owned businesses by the end of 2025, along with plans to increase representation in hiring and supplier relationships. However, following pressure from conservative activists and legal threats from President Donald Trump’s administration, Target announced it was scaling back these initiatives, a move seen by some consumers as a betrayal of prior commitments.

This boycott poses both short-term risks and long-term uncertainties. Historically, consumer boycotts have had mixed success, with many failing to generate sustained financial damage. However, Target has already felt the impact, reporting a decline in February net sales. Q1 2025 earnings will be important to monitor, as any prolonged revenue decline could pressure profit margins. Additionally, Trump’s recently imposed tariffs on imports from China, Canada, and Mexico are expected to increase costs on essential goods, which Target has warned may lead to price hikes—potentially further impacting consumer sentiment and sales.

Investor confidence could waver if the boycott gains momentum beyond the Lenten period. Target stock has already faced downward pressure, with some investors choosing to divest in solidarity with the movement. If other major retailers like Amazon and Walmart, which have also scaled back DEI programs, face similar boycotts, this could indicate a broader consumer-driven shift in corporate accountability expectations.

The longer-term risk for Target lies in brand reputation and customer loyalty. The company has positioned itself as a progressive retailer, appealing to millennial and Gen Z consumers, who often prioritize social responsibility in their shopping choices. A perceived reversal on DEI efforts could alienate key demographics, particularly Black consumers, LGBTQ+ shoppers, and progressive-minded customers, who have been instrumental in Target’s market positioning.

While it remains to be seen whether this boycott will significantly impact Target’s bottom line, investors should watch alt data, and management’s response to the controversy. If the boycott extends beyond the initial 40 days or escalates into broader consumer discontent, it could become a longer-term headwind for the retailer’s stock and overall business strategy.

Brown-Forman Corporation ($BF-B):

Jack Daniel’s, one of America’s most recognizable whiskey brands, is at the center of an escalating trade dispute between the United States and Canada. In retaliation for President Donald Trump’s new tariffs on Canadian goods, several Canadian provinces, including Ontario and Nova Scotia, removed U.S.-made alcoholic beverages from liquor store shelves. The move has drawn sharp criticism from Lawson Whiting, CEO of Brown-Forman, Jack Daniel’s parent company, who called it “worse than a tariff” and a “disproportionate response” to the U.S. government’s actions.

Despite the aggressive stance taken by Canada, the immediate financial impact on Brown-Forman is expected to be minimal, as the Canadian market accounts for only ~1% of the company’s total sales. While Jack Daniel’s will experience a short-term loss in revenue from Ontario’s Liquor Control Board (LCBO)—one of the world’s largest alcohol purchasers—this represents only a fraction of the company’s global sales footprint. Brown-Forman generates the majority of its revenue in the United States, Europe, and emerging markets such as Mexico and Poland.

However, the bigger concern for Jack Daniel’s may be its brand perception and market positioning. Canada has historically been a strong export market for American whiskey, and the removal of its products could force Canadian consumers to adopt local alternatives, potentially causing long-term shifts in buying habits. Additionally, the growing nationalist sentiment in Canada, fueled by frustration over U.S. tariffs, could reinforce a “buy Canadian” movement that extends beyond just whiskey and into other consumer categories.

Brown-Forman’s ability to weather geopolitical challenges and maintain strong global sales growth will be key. The company has already been dealing with sluggish demand in North America and Europe, leading to cost-cutting measures, including layoffs and operational efficiencies. However, its diversified portfolio and strong presence in high-growth markets like Mexico (7% of sales) provide some insulation against localized disruptions.

While the Canadian boycott is unlikely to materially affect Brown-Forman’s bottom line, it underscores the risks of global trade tensions impacting multinational brands. If similar trade disputes arise in Mexico or Europe, where Brown-Forman has a much larger revenue exposure, the financial impact could be more significant.

Apple Inc ($AAPL):

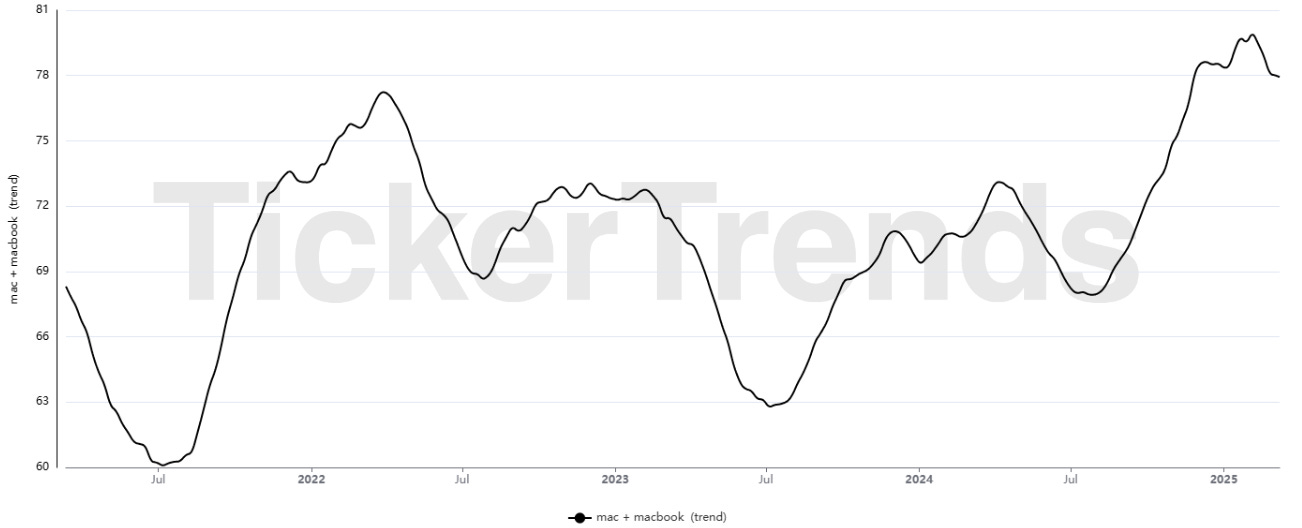

Apple has unveiled the new MacBook Air with the M4 chip, delivering a significant performance boost, improved features, and a lower starting price of $999 ($899 for education customers). This marks a $100 price cut compared to its predecessor, making the MacBook Air more accessible than ever. With a 10-core CPU, up to a 10-core GPU, and support for up to 32GB of unified memory, the M4 chip provides a substantial performance leap. Apple claims it is up to 2x faster than the M1 MacBook Air and 23x faster than the last Intel-based model, making it an attractive upgrade for both existing Mac users and those still holding onto older Intel-powered devices. Additionally, Apple introduced an all-new sky blue color, replacing the previous Space Gray option, further refreshing the MacBook Air lineup.

Apple’s continued push to grow its Mac ecosystem while ensuring strong hardware sales. The lower price point is a strategic effort to attract first-time Mac buyers, students, and professionals looking for an affordable yet powerful laptop. By making its entry-level MacBook more accessible, Apple is not only expanding its user base but also positioning itself to increase revenue from software and services, such as iCloud subscriptions, App Store purchases, and accessories like the Magic Keyboard and AirPods. This aligns with Apple's long-term business strategy of driving recurring revenue through ecosystem lock-in.

The M4 chip’s AI capabilities are another major focus, as Apple continues to integrate Apple Intelligence across its product lineup. With a Neural Engine up to 3x faster than the M1, AI-driven features like photo enhancement, voice recognition, and background noise removal are set to become more powerful. This could help drive adoption of macOS Sequoia’s AI-powered features, reinforcing Apple’s position in the growing AI market. Given that Apple’s ecosystem thrives on seamless integration between devices, the MacBook Air's AI capabilities will complement AI-powered features on iPhones, iPads, and upcoming Apple products, ensuring a consistent user experience.

The MacBook Air refresh comes at a crucial time, as Mac sales faced a slowdown in 2023 and early 2024 due to post-pandemic market saturation. The price reduction, improved AI performance, and expanded external display support (up to two 6K monitors) could stimulate demand, particularly among Intel Mac holdouts and students upgrading from older laptops. Additionally, Apple’s education discount makes the MacBook Air a compelling option for students and institutions, further supporting revenue growth in the education sector.

Alongside the MacBook Air, Apple also introduced a new Mac Studio, powered by the M4 Max and M3 Ultra chips, targeting creative professionals, developers, and AI engineers. This ensures Apple remains competitive in the high-end computing market, particularly against Windows-based workstations from Dell, HP, and Lenovo. With AI workloads becoming increasingly demanding, Apple is positioning its Mac lineup as the go-to choice for professionals in AI, machine learning, and video production. This high-performance segment, while smaller than Apple’s consumer market, is crucial for maintaining brand prestige and margin-rich hardware sales.

Sweetgreen Inc ($SG):

Sweetgreen has officially launched Ripple Fries, a new air-fried, seed oil-free take on the classic French fry, now available at all 246 locations nationwide. Made from russet potatoes, avocado oil, salt, and herbs, the fries feature a unique wavy cut, designed to maximize crispiness without the need for deep-frying. Customers can pair their order with house-made Pickle Ketchup or Garlic Aioli, reinforcing Sweetgreen’s commitment to clean, high-quality ingredients. The fries were introduced following a successful test run in Los Angeles and mark Sweetgreen’s latest effort to redefine fast food with healthier alternatives.

This launch aligns with Sweetgreen’s strategy to expand beyond salads and attract a wider customer base. The addition of a craveable side item could drive higher order values, increasing average ticket size and frequency of visits. As CEO Jonathan Neman stated, “We want to give you those things that you want, that you’re used to eating—things like fries—and do it in a Sweetgreen way.” This move taps into the "permissible indulgence" trend, appealing to health-conscious consumers who still crave classic comfort foods.

Additionally, the introduction of Ripple Fries coincides with Sweetgreen’s new loyalty program, SG Rewards, which allows customers to earn points for every dollar spent. This is a smart retention strategy, encouraging repeat visits and deeper brand engagement. The timing is crucial, as Sweetgreen faced sales slowdowns due to bad weather in early 2025. The fries, combined with the revamped loyalty program, could serve as key revenue drivers as the company aims to rebound.

Beyond the financial impact, Ripple Fries reinforce Sweetgreen’s brand positioning in the fast-casual space. Unlike traditional fries, which are typically deep-fried in seed oils, Sweetgreen’s version is air-fried in avocado oil, making it a unique differentiator in the market. This aligns with the brand’s broader health-focused initiatives, such as eliminating seed oils from its entire menu in early 2025. Sweetgreen’s pivot toward more transparent, whole-food ingredients resonates with modern consumers, particularly those following clean-eating trends.

Initial customer feedback has been overwhelmingly positive, with early tasters praising the fries’ light, crispy texture and flavorful seasoning. Some TikTok reviewers noted that the fries weren’t as crunchy as traditional deep-fried versions but were well-seasoned and enjoyable, with the pickle ketchup receiving particularly strong praise. Given the success of past healthier takes on comfort food, such as Sweetgreen’s air-fried Brussels sprouts and caramelized garlic steak, Ripple Fries seem poised to become a menu staple. This expansion signals Sweetgreen’s ambition to compete with larger fast-food chains while maintaining its health-conscious ethos. The move could help the company attract new customers who may not have previously considered Sweetgreen for a meal. By adding a universally loved item like fries, Sweetgreen is strengthening its positioning as a viable alternative to traditional fast food.

The success of Ripple Fries could pave the way for more indulgent-yet-healthier menu additions, broadening Sweetgreen’s appeal beyond its core salad-loving audience. As fast-casual chains continue evolving, Sweetgreen’s commitment to innovation, clean ingredients, and better-for-you fast food could drive long-term growth and differentiation in a competitive market.

Chipotle Mexican Grill, Inc. ($CMG):

Chipotle has officially launched Chipotle Honey Chicken, a new sweet and spicy protein option available across North America, the U.K., France, and Germany starting March 7. This limited-time menu addition features grilled chicken seasoned with Mexican spices, marinated in a blend of seared, smoked chipotle peppers and wildflower honey, creating a perfect balance of heat and sweetness. Following successful test markets in Nashville and Sacramento, where it became Chipotle’s top-performing limited-time offer, the brand is bringing this fan-favorite protein to its global menu.

Chipotle’s strategic approach to introducing new, buzzworthy proteins has consistently driven higher customer engagement and sales. With the “swicy” (sweet and spicy) trend gaining momentum, the launch of Chipotle Honey Chicken positions the company to capitalize on consumer demand for bold, flavorful innovations. As Chipotle Rewards members received exclusive early access on March 6, the company is leveraging its loyalty program to boost digital orders and drive customer retention.

Chipotle’s marketing strategy around this launch aligns with its proven success formula—introducing limited-time, premium proteins that encourage repeat visits and menu experimentation. This move follows past successful launches like Carne Asada and Chicken Al Pastor, both of which saw strong customer demand and multiple returns to the menu. The introduction of Chipotle Honey Chicken could serve as another catalyst for increased sales, particularly as the brand continues to expand its international footprint.

Early reviews highlight the protein’s well-balanced flavor. Unlike Chipotle’s spicier Al Pastor chicken, the Honey Chicken offers a smokier, more nuanced kick, enhanced by the caramelization of the wildflower honey over the grill. Many testers preferred it in quesadillas, where the flavor shines without being overpowered by other toppings. However, it also works well in bowls and burritos, especially when paired with Chipotle’s fan-favorite Honey Vinaigrette. Chipotle is also promoting a “Most Popular Chipotle Honey Chicken Bowl” on its app and website for easy ordering. This bowl contains 880 calories and features white rice, black beans, fajita veggies, fresh tomato salsa, roasted chili-corn salsa, sour cream, cheese, and lettuce. The addition of a pre-curated bowl simplifies the ordering process, making it easier for customers to experience the new protein without hesitation.

This launch underscores Chipotle’s ability to innovate while staying true to its core menu. The company has a track record of successfully introducing limited-time items that often translate into long-term menu expansions or recurring seasonal offerings. The strong early response to Chipotle Honey Chicken suggests it could follow a similar path, further solidifying Chipotle’s reputation as a leader in the fast-casual space. The success of this launch could pave the way for future protein innovations, as Chipotle continues to test and refine new menu items based on consumer preferences. As the brand prioritizes high-quality ingredients and bold flavors, offerings like Chipotle Honey Chicken help differentiate it from traditional fast-food competitors while keeping the menu fresh and exciting for loyal customers.

Uber Technologies Inc ($UBER):

Uber and Waymo have officially launched driverless ride-hailing services in Austin, Texas, just in time for SXSW 2025. Riders using UberX, Uber Green, Uber Comfort, or Uber Comfort Electric now have the chance to be matched with Waymo’s fully autonomous Jaguar I-PACE vehicles at no extra cost. This move marks a significant shift in the ride-hailing industry, as Uber and Waymo—once fierce rivals—are now collaborating to scale driverless technology in urban markets.

Uber’s partnership with Waymo could reduce long-term operational costs by eliminating the need for human drivers. This integration allows Uber to compete with Tesla, which is developing its own ride-hailing service. Additionally, as autonomous vehicle adoption grows, Uber can improve its margins by offering more rides without driver compensation. Austin has become a key testing ground for autonomous vehicles, thanks to its tech-friendly regulations and infrastructure. Currently, Waymo operates within a 37-square-mile service area, covering Downtown, Hyde Park, Montopolis, and other major neighborhoods. The company plans to expand its coverage over time, and Atlanta is next in line for Waymo-powered Uber rides later this year.

For riders, using a Waymo vehicle is a seamless experience through the Uber app. Users can increase their chances of getting a Waymo ride by opting in under “Ride Preferences” in the app’s settings. The all-electric Jaguar I-PACE Waymo vehicles are easily recognizable—they are white SUVs with black rims and a distinctive cylinder sensor on the roof. Once matched with a Waymo ride, users can unlock the car, open the trunk, and start the trip directly through the Uber app. Additionally, the app provides 24/7 human support if any issues arise.

While autonomous ride-hailing is expanding, it still faces significant hurdles. General Motors' Cruise division recently halted its robotaxi services after a safety incident in San Francisco, raising concerns about regulatory oversight and consumer confidence. In contrast, Waymo has accumulated tens of millions of miles of real-world driving experience, positioning it as a leader in safe autonomous mobility. Competition in Austin’s autonomous ride-hailing market is heating up, as Tesla is also preparing to launch its own driverless ride service. With Tesla’s Gigafactory based in Austin, Uber and Waymo must act swiftly to capture market share before Tesla enters the space. The next few years will determine which companies emerge as dominant players in autonomous mobility.

For now, SXSW attendees and Austin residents have the first opportunity to experience Uber’s driverless future. With no extra cost and no tipping required, Uber and Waymo are making it easier than ever to ride into the future of transportation